When a loved one passes away, it's often the smallest things that keep their memory alive—a handwritten note, a familiar scent, or the sound of their favorite song. While grief is personal, many individuals want to do more than hold onto memories—they want to create a lasting legacy. A Nevada estate planning attorney can help clients structure their estate plans to include purposeful tributes and lasting remembrances, such as charitable donations, personalized memorials, or family heirlooms. Estate planning is not just about distributing wealth—it's about preserving values, stories, and emotional connections that endure for generations. By incorporating these elements into a thoughtful estate plan, you can ensure that your loved one's memory is honored in meaningful and lasting ways.

Today’s families are moving away from traditional funerals in favor of more personalized celebrations of life. This cultural shift includes everything from eco-friendly burials to events that reflect the deceased’s passions—favorite music, personal stories, or hobbies. Estate planning can help fund and structure these memorials in advance, easing financial burdens and allowing families to focus on remembrance. For instance, advance planning can ensure that a family's favorite location is preserved as a memorial site, providing a place where future generations can visit and remember their loved ones. Additionally, knowing that these arrangements are in place can bring peace of mind to those who are grieving. By integrating personalized memorial planning into your estate plan, you can create a celebration that truly reflects the life and spirit of your loved one.

Today’s families are moving away from traditional funerals in favor of more personalized celebrations of life. This cultural shift includes everything from eco-friendly burials to events that reflect the deceased’s passions—favorite music, personal stories, or hobbies. Estate planning can help fund and structure these memorials in advance, easing financial burdens and allowing families to focus on remembrance. For instance, advance planning can ensure that a family's favorite location is preserved as a memorial site, providing a place where future generations can visit and remember their loved ones. Additionally, knowing that these arrangements are in place can bring peace of mind to those who are grieving. By integrating personalized memorial planning into your estate plan, you can create a celebration that truly reflects the life and spirit of your loved one.

Personalized memorial planning also allows families to incorporate meaningful traditions and rituals into their celebrations. This might include holding a memorial service at a specific location that held significance to the deceased, or creating a custom ceremony that honors their cultural or personal heritage. Estate planning attorneys can assist in navigating these complex decisions, ensuring that your wishes are respected and carried out. Furthermore, by addressing these details in advance, families can avoid disagreements and focus on the therapeutic process of remembrance. This thoughtful approach helps preserve the emotional connection and values that are essential to your family's legacy.0

Nevada estate planning offers the flexibility to create customized memorials that reflect the unique personality and achievements of your loved one. Whether it's establishing a memorial fund, creating a personalized memorial plaque, or organizing a charity event in their name, these efforts can be seamlessly integrated into your estate plan. By doing so, you're not only honoring their memory but also ensuring that their legacy continues to inspire future generations. This individualized approach allows families to celebrate their loved one's life in a way that is both authentic and meaningful. Moreover, it provides a sense of continuity and connection to the past, which is crucial for the emotional well-being of surviving family members.

Through Nevada estate planning tools such as revocable trusts, testamentary gifts, or memorial funds, individuals can earmark resources for tributes like tree plantings, park benches, scholarships, artwork, and donations to causes their loved ones cared about. These strategies ensure that honoring a memory doesn’t place an unexpected financial strain on surviving family members. By structuring your estate plan to include these creative tributes, you can ensure that your loved one's legacy is celebrated in a way that reflects their values and passions. This approach not only honors their memory but also contributes positively to the community or environment. Additionally, it provides a tangible way for family members to engage with the legacy of their loved one, fostering a deeper connection to their heritage.

Using estate assets to fund creative tributes also allows for the preservation of stories and memories associated with these gestures. For instance, a scholarship fund established in a loved one's name can include a personal message or story about their achievements and values. This ensures that future recipients understand the significance of the award and the legacy it represents. Moreover, by incorporating these elements into a Nevada estate plan, you can leverage the state's favorable trust laws to protect and grow the assets dedicated to these tributes. This strategic planning helps maximize the impact of your tribute while minimizing tax liabilities. Furthermore, it provides peace of mind knowing that your intentions will be respected and fulfilled.

Incorporating these strategies into your Nevada estate plan also allows for flexibility and customization. You can choose to allocate funds for various types of tributes based on your loved one's interests and achievements. For example, if your loved one was an artist, you might establish a fund to support local art programs or create a public art installation in their honor. This approach ensures that your tribute is both meaningful and impactful, reflecting the unique spirit and contributions of your loved one. By working with an estate planning attorney, you can ensure that these wishes are legally formalized and effectively carried out. Additionally, this personalized approach helps preserve the emotional connection between generations, reinforcing shared values and cultural traditions.

Belongings like clothing, books, recipes, or letters often carry deep emotional value. A thoughtful estate plan can include instructions for repurposing items into keepsakes—such as quilts, scrapbooks, or memory boxes—preserving not only possessions but the stories behind them. A Nevada estate planning attorney can help legally formalize these wishes to avoid confusion or conflict. By incorporating these personal items into your estate plan, you ensure that they are distributed in a way that honors their emotional significance. This thoughtful approach helps preserve the history and sentimentality associated with these belongings, providing future generations with a tangible connection to their heritage.

Intentionally gifting sentimental property also allows for the creation of lasting family heirlooms. For instance, a cherished piece of jewelry can be passed down through generations, serving as a symbol of love and continuity. By specifying how these items should be used or distributed, you can ensure that their emotional value is respected and preserved. Moreover, including these items in a Nevada estate plan helps avoid potential disputes among family members, as everyone understands the intended use and significance of each item. This clarity provides peace of mind and reinforces the emotional bond between family members, even after a loved one's passing.

Nevada estate planning offers a structured approach to managing sentimental property, ensuring that your wishes regarding these personal items are respected and carried out. By working with an experienced attorney, you can create a detailed plan that not only safeguards these belongings but also tells the story of their significance. This thoughtful approach preserves the cultural and emotional legacy of your family, providing future generations with a rich tapestry of stories and memories. Furthermore, it allows you to pass on more than just material possessions; you share the values, traditions, and personal history that make your family unique. By integrating these elements into your estate plan, you ensure that your loved one's memory is cherished and celebrated in meaningful ways.

Creating a memory-centered estate plan provides comfort and guidance to heirs. Whether it’s preserving digital assets, writing personal messages into a trust, or allocating funds for future family rituals, intentional planning ensures a loved one’s essence is never lost. These efforts can also reinforce shared values, cultural traditions, and emotional continuity within families. By crafting a legacy plan that honors your loved one's memory, you're not only preserving their emotional legacy but also providing a framework for future generations to connect with their heritage.

Legacy planning through Nevada estate planning allows for the preservation of family stories and values across generations. By including personal messages or stories in a trust, you can share the context and significance of your family's history and traditions. This thoughtful approach ensures that future generations understand the importance of certain rituals or practices, maintaining a strong sense of continuity and shared identity. Moreover, by structuring your estate plan to support these efforts, you can create a lasting impact that transcends material wealth. This legacy becomes a source of strength and inspiration for your family, providing a sense of belonging and connection to their past.

Incorporating legacy planning into your estate strategy also allows for the preservation of digital assets, such as emails, photos, or videos, which are increasingly important in today’s digital age. By specifying how these digital artifacts should be managed and preserved, you can ensure that they remain accessible and meaningful for future generations. This approach not only safeguards your family's digital legacy but also provides a way to honor your loved one's memory in a modern, relevant way. Furthermore, it reinforces the emotional connection between generations, allowing your family's story to unfold over time. By working with a Nevada estate planning attorney, you can create a comprehensive plan that honors your loved one's legacy while supporting the evolving needs of your family.

Closing the Circle: Honoring Memories Through Thoughtful Planning

By incorporating memorial planning, creative tributes, intentional gifting of sentimental property, and legacy planning into your Nevada estate plan, you can create a lasting and meaningful tribute to your loved one. These strategies not only honor their memory but also provide a sense of continuity and connection that supports future generations. Whether you're planning for yourself or a loved one, taking the time to craft a thoughtful estate plan can bring peace of mind and ensure that your wishes are respected. Consider scheduling a consultation with a Nevada estate planning attorney to explore these options and create a personalized plan that reflects your values and intentions. This step will help you turn your vision into reality, ensuring that your loved one's memory is cherished and protected for years to come.

joint ownership risksNevada estate planning for farmers and ranchers goes beyond basic legal documents—it safeguards a legacy built on land, hard work, and family commitment. Agriculture-focused families in northern Nevada face unique challenges that demand more than generic solutions. The choices you make today directly affect who inherits your ranch, how land is managed, and whether the family legacy continues. Failing to address these issues now can result in costly disputes, unplanned taxes, or lost opportunities for the next generation.

No Estate Plan or Delayed Planning: The Risks and Realities

Many farm and ranch families avoid or delay estate planning because it feels overwhelming or uncomfortable. The process involves difficult decisions about dividing land, machinery, livestock, and business interests among heirs, especially when not all children want to remain in agriculture. Without a clear plan, your family could face confusion, legal battles, and significant tax burdens after you pass. The lack of planning often leads to forced sales of property or equipment just to cover debts or administrative costs. A carefully crafted Nevada estate plan, guided by experienced professionals, provides certainty and protects the future of your farm or ranch for generations.

Many farm and ranch families avoid or delay estate planning because it feels overwhelming or uncomfortable. The process involves difficult decisions about dividing land, machinery, livestock, and business interests among heirs, especially when not all children want to remain in agriculture. Without a clear plan, your family could face confusion, legal battles, and significant tax burdens after you pass. The lack of planning often leads to forced sales of property or equipment just to cover debts or administrative costs. A carefully crafted Nevada estate plan, guided by experienced professionals, provides certainty and protects the future of your farm or ranch for generations.

Procrastinating can turn what should be a thoughtful transition into a crisis for your loved ones. When there is no estate plan, state law determines how assets are distributed, often ignoring your personal wishes or the unique dynamics of your family. This default approach rarely aligns with the needs of agricultural families, who may require certain heirs to inherit specific assets for operational continuity. Family disputes become more likely when intentions are unclear or unspoken, leading to strained relationships and potential court interventions. Taking proactive steps now allows you to shape your legacy and avoid unnecessary conflict.

The stakes are especially high for farm and ranch families, where land and business operations are deeply intertwined. An outdated or absent estate plan can result in mismanagement, lost income, or even the breakup of the family enterprise. Many families have seen generational land converted to non-agricultural uses simply because there was no plan in place to keep it productive. Regular reviews and updates with an experienced estate planning attorney ensure your wishes are current and legally enforceable. Investing in a comprehensive plan today secures your legacy and provides peace of mind for years to come.

Strategic Structuring Beyond Joint Ownership

Joint ownership often seems like a simple fix for transferring farm or ranch assets, but it presents hidden risks for agriculture families. Adding a child or partner as a joint owner may unintentionally expose your assets to their personal debts, divorce settlements, or lawsuits. This arrangement can also jeopardize USDA subsidy eligibility or complicate business operations when multiple owners disagree. Relying solely on joint ownership can mean losing control over critical decisions about the land or enterprise. Instead, modern estate planning offers more robust tools designed specifically for agricultural families.

Establishing a trust or forming a business entity like an LLC provides better protection and flexibility for your farm or ranch. These structures allow you to specify who inherits what, set conditions for management, and protect assets from outside threats. Trusts and LLCs also offer tax advantages and can help minimize estate taxes, which can be especially burdensome for large landholdings. By structuring ownership thoughtfully, you ensure that the operation remains cohesive and sustainable for future generations. Strategic planning preserves your family’s control and maximizes the benefits you want to pass down.

Each family’s situation is unique, and what works for one operation may not serve another’s best interests. A tailored approach considers your goals, the potential for future conflicts, and the long-term viability of the farm or ranch. Professional advisors can help you navigate the complexities of Nevada estate planning, selecting the best structures for your specific needs. Avoiding simple fixes that only create more problems down the road is essential for protecting your legacy. Thoughtful planning today means your family won’t face avoidable complications tomorrow.

Liquidity and Cash Flow: Essential Elements for Smooth Transitions

Many farming and ranching families find themselves asset-rich but cash-poor, which can be dangerous when a transition occurs. Without adequate liquidity, your family may be forced to sell land or equipment quickly to cover debts, taxes, or administrative expenses. These rapid sales often happen at below-market value, resulting in unnecessary financial loss. Estate planning should include strategies to generate cash flow when needed, ensuring your family doesn’t have to make hasty or harmful decisions during a difficult time.

Life insurance trusts, access to credit, and asset diversification are key tools for managing liquidity in estate planning. Life insurance provides a source of immediate funds to cover estate taxes or operational costs, helping preserve the core assets of your farm or ranch. Arranging credit in advance ensures your family can access capital without resorting to emergency sales. Diversifying assets reduces the risk of all resources being tied up in land or equipment, making transitions smoother and less stressful. These strategies require advance planning and expert guidance to implement effectively.

Addressing cash flow concerns also helps maintain family harmony by removing financial pressures from the estate settlement process. When heirs don’t need to worry about how to pay bills or taxes, they can focus on continuing the family legacy. Ignoring liquidity needs puts your entire operation at risk and can derail even the best-laid succession plans. A comprehensive Nevada estate plan evaluates your financial situation and builds in safeguards to protect your family and business. Working with professionals who understand agriculture-specific challenges ensures these issues are addressed before they become emergencies.

The Value of Nevada-Specific Estate Planning Advisors

Nevada’s unique laws regarding water rights, real property, and agricultural business make estate planning for farmers and ranchers especially complex. Using out-of-state templates or generalist advisors can result in costly mistakes and oversights that jeopardize your family’s future. Templates designed for other regions often neglect Nevada-specific requirements, leaving your plan vulnerable to legal challenges or administrative hurdles. Only professionals who are intimately familiar with local regulations can create an estate plan that truly protects your interests and those of your heirs.

A knowledgeable Nevada estate planning attorney understands the nuances of agricultural asset valuation, tax planning, and land use restrictions. They can help structure your estate to minimize tax exposure, maintain USDA eligibility, and preserve water rights for future generations. Local expertise is especially important when navigating probate, which can be costly and time-consuming for large estates. Working with an advisor who knows your state’s laws ensures your plan is both legally sound and practically effective. Their guidance can save your family thousands of dollars in unnecessary expenses and uncertainty.

Finding the right professional team—including attorneys, accountants, and financial advisors—is critical for comprehensive estate planning. These experts can help you anticipate and address issues before they become problems, protecting your farm or ranch from unintended consequences. The team at Andersen Dorn and Rader specializes in the unique needs of Nevada’s agricultural families and businesses, offering the insight and experience you need for a successful transition. Meeting with a qualified estate planning attorney is the next logical step to ensure your legacy remains intact. Their tailored guidance will help you avoid the common pitfalls that could otherwise put your family’s future at risk.

As a business owner or manager in Nevada agriculture, you have a responsibility not only to your family but also to the land and community. Estate planning is not just about paperwork—it is about preserving the way of life you have worked hard to establish. By addressing these common mistakes and seeking expert guidance, you can ensure that your farm or ranch remains a source of pride and prosperity for generations. Schedule a consultation with a qualified Nevada estate planning attorney who understands the unique challenges of agriculture and is ready to help you build a legacy-preserving plan. Your proactive approach today will make all the difference for your family’s tomorrow.

Nevada estate planning is often associated with financial assets, but true legacy extends beyond wealth. In Nevada, estate planning offers a unique opportunity to pass down values, traditions, and life lessons alongside financial security. Families can strengthen connections and ensure that future generations inherit not just money, but also meaningful personal history and guiding principles.

Estate planning professionals help individuals integrate their values into legally sound plans, ensuring that family stories, philanthropic interests, and personal philosophies endure for generations.

Well-crafted Nevada estate planning reflects more than asset distribution; it embodies a person’s values and legacy. In Nevada, incorporating family traditions, ethical principles, and life lessons into a Nevada estate plan allows individuals to influence future generations in profound ways.

Methods for Communicating Values

Methods for Communicating ValuesModern Nevada estate planning tools make it easier than ever to preserve and protect family stories and traditions for future generations.

Aligning financial planning with personal values creates a more meaningful legacy. Trusts offer a structured way to support family members while reinforcing specific principles.

Nevada’s legal landscape presents distinct advantages for estate planning. Understanding these aspects ensures a smooth, legally sound process for passing down assets and values.

Estate planning in Nevada provides an opportunity to leave behind more than financial assets. Thoughtful planning ensures that values, traditions, and personal philosophies continue to guide future generations.

Working with an experienced estate planning attorney simplifies this process. Anderson, Dorn & Rader Ltd. helps clients structure their estate plans to include personal legacies, ensuring a meaningful transfer of wealth and wisdom.

A well-designed estate plan is more than a financial document—it is a roadmap for the future, ensuring that your values endure for generations to come.

Many newlyweds assume estate planning is something to think about later in life or after starting a family. However, without a proper estate plan, Nevada state law will determine how assets are distributed, which may not align with a couple’s wishes. Estate planning ensures financial security, protects assets, and prevents unnecessary legal complications.

For those who believe joint ownership or a prenuptial agreement is sufficient, it’s important to understand that estate planning goes beyond these arrangements. This article explores common myths and frequently asked questions about estate planning for newlyweds and explains why having a well-structured plan is essential.

A common misconception is that jointly owning all assets means an estate plan is unnecessary because the surviving spouse automatically inherits everything. While joint ownership can ensure a seamless transfer in many cases, there are significant risks to consider:

A comprehensive estate plan ensures that assets are protected, properly distributed, and managed in the event of incapacity.

A prenuptial agreement is designed to clarify asset distribution in case of divorce or death, but it does not address all essential estate planning concerns. Couples relying solely on a prenup may face unexpected legal challenges.

A well-structured estate plan provides security beyond what a prenuptial agreement offers by ensuring financial and medical decisions are properly managed.

Even without children, newlyweds need to consider how their assets will be handled in case of incapacity or death. Many assume their spouse will automatically inherit everything, but this is not always the case.

Creating a Nevada estate plan early in marriage helps avoid complications and ensures assets are managed according to the couple’s wishes.

Some newlyweds hesitate to start estate planning if they anticipate moving in the near future. However, delaying estate planning can leave a couple unprotected in an emergency.

Newlyweds should take proactive steps now to establish estate planning protections rather than waiting until after a move.

Estate planning is a crucial step for newlyweds looking to protect their assets, ensure financial security, and avoid legal complications. A well-structured estate plan provides protections that joint ownership and prenuptial agreements alone cannot offer.

Couples ready to take control of their financial future should schedule a consultation with Anderson, Dorn & Rader Ltd.. Their team of experienced Nevada estate planning attorneys can help create a customized plan tailored to each couple’s unique needs.

Planning for the future involves making thoughtful decisions about how your assets will be distributed and ensuring that your wishes are carried out. For parents with an only child, estate planning presents unique considerations. While having one child simplifies certain aspects, it also requires tailored strategies to address potential challenges. By working with a Nevada estate planning attorney, families can create a plan that reflects their values and priorities while safeguarding their child’s future.

In recent decades, one-child families have become increasingly common. Census data shows that the average family size in the United States has decreased, with one-child households now accounting for about 22% of families. These shifts challenge traditional stereotypes, including the outdated notion of “only child syndrome.” Modern research reveals that only children develop social skills similar to those with siblings, making this family dynamic more normalized than ever.

For parents in Nevada, these societal changes underscore the importance of estate planning that aligns with modern realities. Creating a plan for an only child involves balancing practical considerations, such as inheritance, with emotional factors, like preserving family harmony.

Parents of only children often find themselves in a better position to provide for their child financially. Forgoing multiple children can mean more resources are available for education, healthcare, and long-term support. However, this economic advantage comes with its own complexities.

One key consideration is the role the child plays in managing the estate. Naming an only child as the sole decision-maker can be straightforward, but it’s not always the best option. Tasks such as acting as an executor, trustee, or power of attorney require specific skills, and overburdening a child with multiple responsibilities can lead to unnecessary stress.

Studies indicate a disconnect between parents’ estate planning intentions and their children’s expectations. For example, a Northwestern Mutual study found that while 32% of millennials and 38% of Gen Z expect an inheritance, only 22% of their parents plan to leave one. Addressing these gaps is crucial for ensuring everyone involved understands the estate plan’s goals.

Parents may also choose to use trusts or conditional gifting to protect their child’s inheritance. Trusts allow parents to distribute funds based on milestones, such as completing a degree or starting a business. These tools ensure that the inheritance serves the child’s long-term interests without overwhelming them.

One of the most critical aspects of estate planning is naming individuals to key roles, such as executor, trustee, or power of attorney. While it might seem logical to assign these responsibilities to your only child, this decision should be carefully evaluated.

Key questions to consider include:

If the answer to any of these questions is no, parents can explore alternative options. Trusted family members, close friends, or professional fiduciaries can step in to ensure the estate is managed competently. Dividing responsibilities among multiple individuals can also provide checks and balances, reducing the potential for conflict.

Parents often struggle to balance practical decisions with the unconditional love they feel for their child. This tension becomes especially apparent when creating an estate plan. While it’s natural to want to leave everything to an only child, there may be good reasons to distribute assets among other loved ones or causes.

For example, parents may choose to allocate a portion of their estate to charities or other family members. Such decisions can reflect broader values while still providing for their child’s needs. Working with a Nevada estate planning attorney helps parents navigate these choices while ensuring their plan is both fair and legally sound.

Navigating the complexities of estate planning requires professional guidance. Anderson, Dorn & Rader Ltd. offers expert advice tailored to the needs of Nevada families. By consulting with experienced attorneys, parents can create a plan that protects their assets, honors their wishes, and secures their child’s future.

Estate planning is not a one-size-fits-all process. For families with an only child, creating a thoughtful plan involves addressing unique challenges and opportunities. To get started, consult with a Nevada estate planning attorney who understands the nuances of your situation. Contact Anderson, Dorn & Rader Ltd. today to schedule a consultation and begin building a plan that works for you and your family.

James Earl Jones, a legendary actor known for iconic roles such as Darth Vader in Star Wars and Mufasa in The Lion King, passed away at age 93, leaving behind a remarkable legacy. His contributions to film, theater, and television are unforgettable, but his approach to estate planning offers valuable lessons for individuals in Nevada. While details of his estate remain private, the principles reflected in his life provide critical insights into the importance of thoughtful planning.

For Nevada residents, estate planning is not only about distributing assets but also about safeguarding privacy, addressing family dynamics, and leaving a legacy that reflects personal values. By working with an experienced Nevada estate planning attorney, such as Anderson, Dorn & Rader Ltd., families can create tailored plans to ensure their wishes are honored.

One of the most significant estate planning tools James Earl Jones likely used was a trust. Trusts offer a way to manage and transfer assets while maintaining privacy. Unlike wills, which become public record during probate, trusts keep financial matters confidential. This approach aligns with Jones’s preference for privacy, both in life and in death.

For Nevada residents, trusts provide an opportunity to bypass probate entirely. This can save time, reduce legal costs, and prevent unnecessary public scrutiny of personal finances. Whether you are protecting real estate, business interests, or personal assets, trusts are a cornerstone of effective estate planning. A Nevada estate planning attorney can guide families in establishing trusts that align with their goals and ensure seamless asset management.

James Earl Jones’s family structure, including his son Flynn and extended relatives, demonstrates the complexities that can arise when creating an estate plan. Balancing the needs of an only child, step-relatives, or other beneficiaries requires careful consideration. In Nevada, addressing these dynamics can prevent future disputes and ensure that all parties feel fairly treated.

Estate plans in Nevada often incorporate trusts and conditional gifts to address unique family circumstances. For instance, parents may establish trusts for a single child while designating other assets for extended family or charitable causes. Additionally, including clear instructions in estate planning documents minimizes ambiguity and helps loved ones navigate decisions with confidence.

Balancing family relationships in estate planning is an essential step for Nevada residents, and Anderson, Dorn & Rader Ltd. offers the expertise to navigate these complexities effectively.

James Earl Jones’s decision to accept a lump sum payment for voicing Darth Vader, rather than a share of profits, serves as a cautionary tale. This choice cost him millions of dollars in potential earnings, underscoring the importance of foresight in financial decisions. Similarly, estate planning mistakes—such as failing to account for future financial growth or not updating plans to reflect life changes—can have lasting repercussions.

In Nevada, estate plans must be dynamic, adapting to evolving family circumstances, financial situations, and legal changes. Regular reviews with a Nevada estate planning attorney ensure that plans remain effective and aligned with current goals. Avoiding costly oversights starts with seeking professional guidance to create and maintain a comprehensive plan.

James Earl Jones’s charitable spirit was evident in his support for causes like the Make-A-Wish Foundation and Habitat for Humanity. Including philanthropy in an estate plan not only reflects personal values but also offers financial benefits, such as tax deductions. For Nevada residents, charitable giving can be seamlessly integrated into estate planning strategies through mechanisms like charitable trusts, donor-advised funds, or direct bequests.

A Nevada estate planning attorney can help identify the best options for incorporating philanthropy into an estate plan, ensuring that donations benefit chosen causes while optimizing tax savings. By including charitable giving in their plans, individuals can extend their legacies beyond their families, making a lasting impact on their communities.

The life and legacy of James Earl Jones underscore the importance of comprehensive estate planning. Whether through preserving privacy, addressing family dynamics, or supporting charitable causes, estate planning ensures that personal values and priorities are honored. For Nevada residents, the stakes are no less significant.

Anderson, Dorn & Rader Ltd. specializes in helping individuals and families create tailored estate plans that reflect their unique circumstances. By working with experienced attorneys, clients gain the peace of mind that comes from knowing their wishes will be respected and their loved ones protected.

Dividing personal property in an estate can be one of the most emotionally challenging aspects of estate administration. Family heirlooms, jewelry, and other sentimental items often hold more emotional value than financial worth, making them prime sources of disputes among beneficiaries. In Nevada, having a well-structured estate plan created with the help of a Nevada estate planning attorney is key to avoiding these conflicts. This article explores various strategies and legal tools available to ensure that personal property is divided fairly and peacefully, helping families avoid unnecessary disputes during an already difficult time.

One of the most effective ways to prevent disputes over personal property is by leaving clear instructions in your will or trust. A detailed estate plan can specify exactly who should receive each item, whether it’s a piece of jewelry, artwork, or other heirlooms. When you work with an experienced Nevada estate planning attorney, you can ensure that your wishes are legally binding and clearly communicated to your beneficiaries.Without specific instructions, items may be lumped into the residuary estate, which can lead to confusion and disagreements among beneficiaries. A residuary clause typically covers any property not specifically mentioned in the will or trust. While this clause is useful for covering general assets, it’s not ideal for personal belongings that may hold sentimental value for multiple family members. To avoid this, it’s essential to include detailed instructions for how these items should be distributed.

A personal property memorandum is an excellent tool for specifying how smaller items should be distributed without constantly updating your will. This document allows you to list specific items and designate beneficiaries for each. It’s especially useful for items like jewelry, collectibles, or sentimental belongings that may not have significant financial value but hold immense emotional value. In Nevada, this memorandum must be referenced in your will or trust to be legally enforceable. Working with a Nevada estate planning attorney ensures that this document is properly integrated into your overall estate plan, reducing the chances of disputes among heirs. The flexibility of this tool allows you to update the list as needed without having to revise your entire will or trust.By using a personal property memorandum, you can ensure that each item is accounted for and distributed according to your wishes. This simple step can prevent misunderstandings and conflicts among family members after your passing.

When no specific instructions are left in the will or trust, families can use several methods to divide personal property fairly. These methods help ensure that everyone feels they’ve had an equal opportunity during the division process:

These methods maintain harmony among beneficiaries while ensuring that personal property is divided equitably. By agreeing on a fair process ahead of time, families can avoid unnecessary tension and focus on honoring their loved one’s memory.

In cases where disputes arise despite best efforts, hiring a mediator or working with an experienced Nevada estate planning attorney can help resolve conflicts. An attorney can provide legal guidance on how to interpret unclear clauses in a will or trust and mediate discussions between family members.The involvement of an impartial third party—whether it’s a mediator or an attorney—can help de-escalate tensions and facilitate productive conversations about dividing personal property. A mediator can guide family members toward mutually agreeable solutions without resorting to litigation, while an attorney ensures that all decisions comply with Nevada law. When emotions run high during estate administration, having professional guidance can make all the difference in reaching peaceful resolutions.

Sometimes, the best strategy for distributing personal possessions is to give things away while the owner is still living. Asking loved ones what they want in advance can give everyone—including the owner—a voice in the discussion about what to do with their belongings. This approach provides more options for dividing possessions fairly and equally. Additionally, gifting personal property before death allows you to witness your loved ones enjoy these items during your lifetime. It also reduces the amount of personal property that needs to be divided after death, simplifying the estate administration process for your executor or trustee. A thorough estate plan goes a long way toward avoiding family fights over heirlooms and keepsakes. Without proper planning, even small misunderstandings over seemingly insignificant items can escalate into full-blown legal disputes.

Executors and trustees play crucial roles in ensuring that personal property is distributed according to the decedent’s wishes. If clear instructions are not provided in the will or trust, these individuals may have some discretion about how to carry out the decedent’s wishes. It’s important for executors and trustees to act impartially when overseeing the distribution of personal property—especially if they are also beneficiaries themselves. In such cases, they must proceed with extra caution to avoid conflicts of interest and ensure that all beneficiaries are treated fairly. If disagreements arise among beneficiaries over specific items, executors or trustees may need to step in as mediators or seek outside mediation services to resolve disputes.

One common mistake people make when dividing personal property is assuming that sentimental items won’t cause disputes because they aren’t financially valuable. In reality, these items often hold tremendous emotional significance for multiple family members—and without clear instructions from the decedent, conflicts are likely to arise. Another mistake is failing to update wills or trusts regularly as circumstances change. For example, new family members may come into the picture (such as through marriage), or certain relationships may evolve over time. Consulting with a Nevada estate planning attorney can help ensure your estate plan is up-to-date and reflects current realities, reducing confusion and potential conflicts among beneficiaries after your passing.

Dividing personal property doesn’t have to lead to family conflict—especially when there’s a clear plan in place. By working with a qualified Nevada estate planning attorney like those at Anderson, Dorn & Rader Ltd., you can ensure that your wishes are honored and that your loved ones are spared from unnecessary stress during an already emotional time.Whether through specific instructions in your will or trust, using tools like a personal property memorandum, or implementing fair methods for dividing assets after death—there are many ways to prevent disputes over sentimental belongings. If you’re ready to take control of how your personal property will be divided after you’re gone—or if you need assistance navigating an existing estate conflict—reach out today for expert guidance tailored specifically for Nevada residents.

When family members discover they’ve been left out of a parent’s estate plan, it can trigger feelings of confusion and frustration. With the ongoing wealth transfer between generations, many anticipate receiving an inheritance, but evolving financial realities often disrupt these expectations. For Nevada families, understanding the legal aspects of disinheritance is essential. Anderson, Dorn & Rader Ltd., a leading estate planning firm in Reno, offers expert guidance for individuals navigating these sensitive situations.

This article provides an overview of inheritance trends, explores possible legal challenges, and identifies when professional legal help is necessary to protect your interests.

According to financial experts, nearly $84 trillion will pass from older to younger generations by 2045, a phenomenon known as the “Great Wealth Transfer.” However, many adult children may not inherit as much as they expect.

Parents are living longer, spending more on retirement, and facing increasing healthcare costs, which can significantly reduce the wealth passed down. Surveys reveal that over half of millennials expect an inheritance of around $350,000 or more, but baby boomers often plan to leave far less. Some don’t plan to leave anything at all, having spent savings on long-term care or lifestyle expenses.

This mismatch in expectations highlights the importance of open family discussions. Anderson, Dorn & Rader Ltd. encourages families to engage in proactive estate planning conversations to avoid misunderstandings and provide clarity on inheritance plans.

In Nevada, children do not have an automatic right to inherit from their parents. If an estate plan explicitly disinherits someone, challenging it can be difficult. However, there are specific circumstances where contesting a will or trust may be legally valid.

Lack of mental capacity can provide grounds to contest an estate plan. If a parent was not of sound mind when drafting their will or trust, the document could be considered invalid. Additionally, undue influence—such as pressure from a caregiver or family member to alter the estate—may also lead to legal challenges.

Errors or misunderstandings are another valid reason to contest a will. For instance, if a parent mistakenly disinherited a child based on false assumptions, such as a belief that the child had financial issues or struggled with addiction, the will or trust may be challenged.

Successfully contesting an estate plan requires clear evidence and professional legal representation. Anderson, Dorn & Rader Ltd. specializes in navigating Nevada’s estate planning laws and offers personalized advice to evaluate your case.

It’s important to identify signs that something may have gone wrong during the estate planning process. A few red flags to watch for include unexplained changes to the estate plan, especially those made shortly before the parent’s death. These alterations can raise questions about undue influence or cognitive decline.

Unknown beneficiaries can also be a cause for concern. If significant assets are left to someone outside the family, such as a new acquaintance or recently involved organization, this may indicate manipulation. Similarly, if one sibling or caregiver receives the majority of the estate without a clear reason, it is worth investigating.

Anderson, Dorn & Rader Ltd. can help uncover inconsistencies in an estate plan and determine if legal intervention is necessary. Their experienced team knows how to gather evidence, analyze documents, and protect your interests through every step of the process.

Navigating estate plans and inheritance disputes without professional help can be overwhelming. Working with knowledgeable estate planning attorneys ensures that you understand your options and rights, minimizing the stress involved in these situations.

Anderson, Dorn & Rader Ltd. provides comprehensive estate planning services in Reno, helping clients access probate records, analyze estate documents, and develop legal strategies. If a parent’s estate plan has gone through probate, their attorneys can help obtain these records to identify beneficiaries and distributions.

The team also offers expert advice on legal strategies. Whether you suspect manipulation, need to access trust documents, or wish to contest an estate plan, their attorneys provide the support necessary to navigate Nevada’s probate courts effectively. Estate planning attorneys offer more than legal expertise—they provide clarity and peace of mind during a time of emotional uncertainty.

Taking the Next Steps with Confidence

If you have questions about your rights or suspect issues with a parent’s estate plan, Anderson, Dorn & Rader Ltd. in Reno is here to help. Their experienced team offers personalized guidance to determine your best course of action. Whether contesting a will, reviewing probate documents, or exploring your inheritance rights, their legal expertise ensures you navigate Nevada’s estate planning laws with confidence.

Why Professional Guidance Makes a Difference

Being excluded from a parent’s estate plan can be difficult, but understanding your legal options empowers you to take action. With trillions of dollars transferring between generations, having a clear plan is essential.

If you are dealing with disinheritance, knowing when to seek professional support is critical. Anderson, Dorn & Rader Ltd. provides expert estate planning services tailored to meet your specific needs, ensuring your questions are addressed and your rights protected.

When planning for the future, few topics are more important than the care of your children and the protection of your assets. If something unexpected happens, ensuring your children are raised by someone you trust is essential. At Anderson, Dorn & Rader Ltd. in Reno, we understand the complexity of these decisions. One critical step is naming a guardian for your minor children and ensuring a sound financial plan that includes leaving an inheritance to grandchildren.

This article explores the importance of naming a guardian and trustee, financial planning for children’s future needs, and strategies to ensure that your legacy benefits your grandchildren.

In Nevada, if you don’t name a guardian, the court will make this decision for you, which may lead to unwanted outcomes. Judges are required to consider the child's best interests, but they do not know your personal values, preferences, or relationships. There is a risk that your children could end up with a relative you don't approve of or, in some cases, a stranger.

By naming a guardian, you gain control over who will raise your children and ensure their upbringing aligns with your values and vision for their future. Your selected guardian will step in to provide emotional support and continuity during a challenging time, following your wishes regarding their education, well-being, and daily life. This peace of mind can be invaluable for parents thinking long-term.

Selecting a guardian requires careful thought. Factors such as the relationship between the potential guardian and your children, their parenting style, and shared values are essential considerations. Stability is also crucial—how familiar your children are with the person, whether they live nearby, and if they can maintain your children’s current school, friendships, and routines.

It is also important to consider the guardian’s health, age, and long-term ability to care for your children. While grandparents may have time and experience, they may struggle with the physical demands of raising young children. On the other hand, younger guardians, such as siblings, may not be in a stable life stage to take on the responsibility.

Before making a decision, have open conversations with your chosen guardian to ensure they are comfortable taking on this role. Naming an alternate guardian provides an extra layer of security if your first choice cannot serve.

Raising children should not impose a financial burden on the guardian. Many parents plan ahead by designating funds through savings, life insurance, or other financial assets. These resources can cover essential needs like housing, education, healthcare, and daily living expenses.

When leaving an inheritance to grandchildren, it is wise to plan how these funds will be managed. Some parents also provide additional financial support, such as helping the guardian upgrade their home or buy a larger vehicle to accommodate their children comfortably.

Ensuring financial stability is crucial for your children’s future and eases the guardian’s responsibilities, allowing them to focus on providing emotional and practical care.

In many situations, it makes sense to assign separate individuals for the roles of guardian and trustee. While the guardian provides emotional and physical care, the trustee manages financial assets for your children or grandchildren. This division of responsibilities ensures that financial resources are used correctly, reducing potential conflicts of interest.

For example, a trusted family member who loves your children may not have the financial expertise to manage investments, life insurance payouts, or property assets. Appointing a trustee with financial experience ensures that funds are managed properly and distributed according to your wishes. This structure also creates accountability, preventing misuse of the inheritance meant to benefit your children or grandchildren.

If no guardian is named in your will or estate plan, a judge will decide who raises your children. In this situation, anyone—including estranged family members—can petition the court for custody. This process can lead to disputes among relatives and result in outcomes that may not align with your preferences.

Naming a guardian as part of your estate plan ensures the court respects your wishes. It also spares your children the emotional stress of uncertainty during an already difficult time.

Proactive estate planning, including naming a guardian and trustee, ensures that your children and grandchildren are protected. While these decisions are challenging, they are essential to creating a secure future for your family.

At Anderson, Dorn & Rader Ltd., we help families in Nevada develop customized estate plans. Whether you need guidance on naming a guardian or advice on leaving an inheritance to grandchildren, our team is here to help.

Planning for the unexpected is an act of love. Naming a guardian and planning financial support through life insurance or inheritance are critical steps in protecting your children’s future. At Anderson, Dorn & Rader Ltd., we offer personalized estate planning services tailored to your family’s needs.

Take the first step toward peace of mind by contacting us for a consultation. We’ll help you navigate the complexities of estate planning, from selecting guardians to managing finances for your children and grandchildren.

When planning your estate, you have options for how to leave an inheritance to your child. The simplest approach is to give them a lump sum without restrictions. However, this may not be suitable for every situation. Concerns about financial responsibility, the potential misuse of funds, or the desire to protect a minor can prompt you to consider setting conditions on their inheritance.

Why Consider Conditional Gifts?

Estate planning allows you to control who receives your assets, when they receive them, and under what conditions. This control can be extended beyond your lifetime through conditional gifts. These gifts ensure that your child receives their inheritance only after meeting certain criteria. This can help shape their behavior, protect them from financial mismanagement, or align their use of the funds with your values.

Types of Conditional Gifts

There are two primary types of conditional gifts:

These conditions can be tailored to fit various goals, such as incentivizing education, ensuring financial responsibility, or encouraging involvement in a family business.

Examples of Conditional Gifts

Parents might set conditions such as:

These conditions can help ensure that your child uses their inheritance in a way that aligns with your intentions and supports their long-term well-being.

Legal Considerations for Conditional Gifts

While you have considerable freedom in setting conditions, there are legal limitations. Courts may not enforce conditions that are illegal, vague, impossible to meet, or against public policy. For instance, conditions that require a beneficiary to divorce or marry within a specific religion may be challenged and potentially voided.

To ensure that your conditions are legally enforceable, it’s crucial to phrase them clearly and consult with a Nevada estate attorney. They can help you draft conditions that are fair, reasonable, and in line with the law, reducing the risk of disputes or legal challenges.

When to Consult a Nevada Estate Attorney

Whether you’re setting up an estate plan or are a beneficiary with questions about conditional gifts, legal guidance is essential. An experienced Nevada estate attorney can help you navigate the complexities of conditional gifting, ensuring that your wishes are honored and your family’s future is secure.

Fewer people are creating estate plans today than in previous years. Research shows that in 2024, less than one-third of Americans have a will. Every adult—regardless of age—should at least have a will, and many could benefit from additional estate planning documents such as trusts, powers of attorney, and advance directives. Even if you have an estate plan, it may no longer align with your current goals if it’s outdated.

As we age, reflecting on our mortality is natural. This can prompt us to take actions to secure our legacy. During the peak of COVID-19, many Americans focused on estate planning, leading to a surge in the creation of wills and trusts. However, this trend has since reversed, with fewer people maintaining up-to-date estate plans.

In 2024, 43% of adults over 55 reported having wills, down from 46% in 2023 and 48% in 2020, according to Caring.com. Additionally, the Center for Retirement Research at Boston College notes that the number of people aged 70 or older with wills declined from 73% in 2000 to 64% in 2020. While more young Americans are creating wills, 75% of those aged 18-54 still don’t have one.

Procrastination, uncertainty about how to start, and concerns about complexity and cost are common reasons for delaying estate planning.

Not having an estate plan, or having an incomplete or outdated one, can lead to significant issues. Without a plan, your family may have to turn to the courts for decisions about your estate, which can be time-consuming, costly, and contentious. Disagreements can lead to legal battles and family discord.

According to "Estate Planning for the Post-Transition Period," 70% of estate settlements result in asset losses or family disharmony due to estate planning failures. Common reasons for failure include lack of follow-through, not informing heirs about the plan, and not keeping the plan updated.

For example, setting up a trust to avoid probate or manage assets for a loved one requires transferring ownership of assets to the trust. Failing to do this means the trust won’t accomplish its purpose. Similarly, creating powers of attorney or medical directives and not informing anyone about them renders these documents useless.

An outdated estate plan can lead to many of the same problems as not having one. Loved ones may not be adequately provided for, assets may go to unintended beneficiaries, and your estate may face unnecessary taxes and probate proceedings.

Estate planning attorneys recommend reviewing your plan every few years or after significant life changes. Here are some signs your estate plan may need updating:

Regularly revisit your estate plan, including agents, beneficiaries, and distribution plans. Ensure you have backup beneficiaries and agents and update provisions to address changing circumstances.

Prepare beneficiaries for their inheritance by discussing how to manage it. If you have doubts about their financial acumen, consider placing the inheritance in a trust with specific usage instructions.

Communicate openly with loved ones about your estate plan’s value and what they can expect. Transparency helps prevent surprises and conflicts. Also, inform them where to find your estate planning documents and ensure they have legal access after your death.

Life is constantly changing, and an outdated estate plan can be nearly as problematic as having no plan at all. While DIY estate planning tools are available, they can lead to significant mistakes. To ensure your estate plan is accurate and effective, contact an estate planning attorney in Reno and schedule an appointment.

The tale of Snow White and the seven dwarfs is a classic, with the central conflict revolving around Snow White's relationship with her stepmother. After the king remarried to provide a motherly figure for Snow White, everything seemed peaceful—until the king's death. The Queen's jealousy drove her to plot against Snow White, a conflict that escalated dramatically. This story, although a fairy tale, highlights the potential family discord that can arise when the head of the family dies without an estate plan. Had the king sought the assistance of an estate planning attorney in Reno, the story could have ended quite differently.

We can only speculate about the king’s wishes, but if he had documented them legally, they would have been clear and enforceable. This would have provided clarity and direction, making it easier for beneficiaries and third parties to honor his intentions.

Revocable Living Trust and Pour-Over Will:

A revocable living trust would have allowed the king to manage his assets during his lifetime and specify how they should be handled after his death. By transferring his assets to the trust or naming the trust as the beneficiary, he could have avoided probate and protected the privacy and inheritance of his loved ones. A pour-over will would ensure any assets not initially placed in the trust would be transferred to it upon his death.

Without a valid estate plan, the law would determine who handles the king’s affairs. This might have placed the stepmother in control due to her status as the surviving spouse. With an estate plan, the king could have designated a trusted friend, advisor, or neutral third party as his personal representative or successor trustee to manage his affairs and protect his daughter's interests.

Snow White, being young, likely needed guidance and oversight for any inheritance. The king could have established a trust for her, either within his will or as part of a revocable living trust, detailing specific instructions for her care and the management of her inheritance. This trust could ensure Snow White received her inheritance at appropriate times and under suitable conditions.

Similarly, the king could have provided for his wife by placing her inheritance in a trust, specifying how and when she would receive it, and ensuring any remaining assets would eventually go to Snow White.

The story of Snow White teaches us valuable lessons about family and inheritance. Ensuring your loved ones are cared for and your wishes are honored requires careful planning. To avoid the pitfalls and ensure a happy ending for your family, contact our estate planning attorneys in Reno. We can help you create a comprehensive plan tailored to your needs and circumstances.

Contemplating the future of our loved ones after we're gone can be tough. While acknowledging our mortality isn't easy, proactive estate planning allows us to ensure our wishes are fulfilled, providing a secure future for those we care about. In Reno, effective estate planning ensures your assets and wishes are properly managed and respected.

The initial step in estate planning is identifying your priorities. Your unique circumstances, the needs of your loved ones, and your philanthropic goals will shape these priorities. Clarifying your goals is essential to work with advisors and ensure sufficient resources to meet your wishes. This teamwork also helps avoid conflicts or issues within your estate plan.

Consider the following common estate planning priorities:

Take the following steps to prepare for creating your estate plan:

Creating a comprehensive estate plan in Reno can be one of the most valuable gifts for your loved ones. By clearly defining your priorities and working with experienced professionals, you can ensure your estate plan reflects your wishes and secures your loved ones' future. Contact us to learn more about how we can help you design a plan tailored to your needs.

When you pass away, your debts, including your mortgage, do not simply vanish. If your will or trust leaves your property, which still has a loan against it, to a beneficiary, they will inherit both the real estate and the remaining debt. The beneficiary might have the option to assume the mortgage, allowing them to retain ownership of the house, or they could opt to sell the property and use the proceeds to settle the debt. The specific outcomes depend on the terms of the mortgage and the directives laid out in the estate plan. Planning ahead for the transfer of your real estate assets can significantly simplify the process for your heirs, making it a smoother transition during a challenging time.

In recent years, American housing debt has soared to unprecedented levels. According to the US Census Bureau, the homeownership rate was approximately 66 percent in 2022. By the end of September 2023, the Federal Reserve Bank of New York reported that Americans were carrying $12.14 trillion in mortgage balances. This figure represents a significant portion of US consumer debt, emphasizing the crucial role of real estate in personal finance. The increase in mortgage debt highlights the importance of addressing how these obligations are managed after the homeowner's death.

With housing debt constituting a substantial part of consumer debt, it's not surprising that many Americans pass away while still owing on their mortgages. A survey by CreditCards.com revealed that 37 percent of Americans died with unpaid mortgages. This situation poses potential complications for heirs and underscores the need for comprehensive estate planning.

The inclination to leave a home to one's children is strong among American parents, with a 2023 Charles Schwab survey indicating that more than three-quarters of parents intend to do so. However, the reality of inheriting a home is complex, especially given the current real estate market dynamics. Nearly 70 percent of potential heirs express a preference to sell the inherited property, often due to financial considerations or the rising costs of real estate.

When it comes to estate planning, one of the critical concerns is how to handle mortgages on inherited properties. The process varies significantly depending on the decedent's estate plan, the terms of the mortgage, and state laws.

When a property is left to a single beneficiary, whether through a will, trust, or deed, several outcomes are possible. The beneficiary might assume the existing mortgage, pay off the mortgage with other funds, or sell the property and use the proceeds to settle the debt. Some lenders may also allow for the refinancing of the loan under the new owner's name, potentially offering more favorable terms.

In cases where multiple beneficiaries inherit a property, the situation becomes more complex. These beneficiaries must agree on how to manage the inherited mortgage, whether by assuming it jointly, selling the property, or using other funds to pay off the debt. Disagreements can lead to legal challenges, potentially resulting in a court-ordered sale of the property.

For those who die without a will or trust, the probate process determines the distribution of their assets, including real estate. The executor of the estate is responsible for managing the deceased's debts and assets, which may involve using estate funds to maintain mortgage payments until the property can be sold or transferred.

Estate planning goes beyond merely distributing assets; it's about ensuring that your legacy is passed on according to your wishes without imposing undue burdens on your loved ones. For homeowners, this means considering the implications of mortgage debt and making arrangements to ease the financial strain on heirs.

An effective estate plan addresses all aspects of your assets, including your home and any outstanding mortgage. It might include setting aside funds to cover mortgage payments, instructions for the sale of the property, or provisions for refinancing the mortgage to benefit your heirs.

Given the complexities of estate law and the intricacies of mortgages, seeking advice from an estate planning attorney is advisable. They can provide tailored guidance that aligns with your goals and ensures your estate is handled smoothly.

As American housing debt continues to climb, the importance of incorporating real estate into your estate planning cannot be overstated. Understanding how your mortgage debt will be managed after your passing is crucial to ensuring your heirs can navigate their inheritance without undue stress. Through careful planning and professional advice, you can secure your legacy and provide for your loved ones even after you're gone.

If you have significant wealth, you may be exposed to future estate tax burdens that must be acted on before the Tax Cuts and Jobs Act reduces the estate tax exemption in 2026. Developing and implementing the right estate planning and tax strategies takes time. You may need to prepare regardless of whether the estate tax continues at its current level or if it is cut in half. This means strategizing to minimize your estate tax liability now.

Meet the Andersons, a well-off family living in a state with a high cost of living. Robert Anderson, the father, is a successful entrepreneur who built a thriving business over the years. His wife, Sarah, is a high salary earner, and together they have accumulated a substantial estate of $8 million each, for a total of $16 million. Their estate is primarily composed of their business assets, valuable artwork, life insurance, a family residence, a vacation home, and other lucrative investments. They have two adult children, James and Emily, both actively involved in the family business.

With the generous federal estate tax exemption set at $10 million adjusted for inflation per individual in 2017, steadily increasing to $13.61 million in 2024, the Andersons have felt relatively secure about avoiding estate taxes. Their primary concern has been preserving the family legacy and ensuring a smooth transition of their assets (business, accounts, and property) to the next generation. They had taken some initial estate planning steps, such as creating a living trust, discussing the use of a family limited partnership, and exploring gifting strategies to transfer the assets to their children gradually.

If the estate tax exemption drops to $5 million adjusted for inflation, the Andersons may face several estate tax issues that require professional advice and assistance before the end of 2025. The Andersons need to find other ways to protect their money and property.

The family business represents a significant portion of the Andersons’ estate, and the sunsetting of the higher exemption amount could have profound implications for its continued viability. Robert and Sarah need to develop a comprehensive business valuation and succession plan now to minimize the total estate tax burden and ensure a smooth ownership transition to James and Emily later.

Given the potential changes in the estate tax landscape, the Andersons need to revisit the valuation of their financial accounts, retirement and life insurance investments, personal property, real estate, and artwork to ensure accurate assessments. Then they need to determine which items will affect the estate tax calculation and any remaining exemption they have left from prior legacy planning. Depending on their assets’ values, these items can easily put them over the potentially soon-to-be lower estate tax exemption, exposing them to a 40 percent tax rate.

With the uncertainty surrounding the estate tax exemption, the Andersons may want to consider accelerated lifetime gifting strategies to reduce their taxable estate while the higher exemption is in place. The Internal Revenue Service declared in 2019 that individuals who take advantage of the increased gift tax exclusion from 2018 to 2025 will not be negatively impacted after 2025 if the exclusion amount drops.1 Gifting up to $13.61 million in 2024 has a zero tax liability. But gifting over $6.4 million in 2026 may have major consequences.

The Andersons may want to use life insurance to ensure that their loved ones are provided for at their passing. They may want to consider creating an irrevocable life insurance trust to own the life insurance policy and be the recipient of the death benefit. This removes the value of the policy from the Andersons’ estate and protects the death benefit for their chosen beneficiaries.

The significant portfolios of high-net-worth and ultra-high-net-worth families may require advanced tax planning techniques, including an AB trust, to optimize each spouse’s estate tax exemption and potentially minimize their estate tax liability. At the client’s death, an amount equal to the current estate tax exemption amount is placed in one trust, which uses the exemption, and the remainder is placed in a second trust for the surviving spouse’s benefit, which qualifies for the unlimited marital deduction. This results in no estate tax being owed at the death of the first spouse.

Spouses are able to give an unlimited amount of money and property to each other without having to worry about estate or gift tax. Because of this, some clients may not have an estate tax issue at the first spouse’s death because everything (or a substantial portion) went to the surviving spouse. Because they are utilizing the unlimited marital deduction, the deceased spouse’s exemption is not needed. However, even if this is the case, it may be advisable to file an estate tax return at the first spouse’s death to document how much of that deceased spouse’s exemption is being used, if any, and that the remainder is going to the surviving spouse. This will allow the surviving spouse to add the deceased spouse’s unused exclusion (DSUE) to the surviving spouse’s own exemption amount and apply that combined amount against their own estate at the time of death.

If the Andersons are philanthropically inclined, another great option would be to engage in charitable giving through the use of a charitable remainder trust. Setting up this type of trust can be time-consuming—sometimes the process is fairly straightforward but often highly complex, requiring advanced planning and consideration.

If your situation is similar to the Andersons, expert guidance is necessary to address estate tax issues and help you evaluate the impact of the potential sunsetting of the higher estate tax exemption amount on your estate. Contact us to learn more about strategies to protect, preserve, and pass down valuable property.

1 Estate and Gift Tax Facts, IRS.gov, https://www.irs.gov/newsroom/estate-and-gift-tax-faqs# (last updated Dec. 5, 2023).

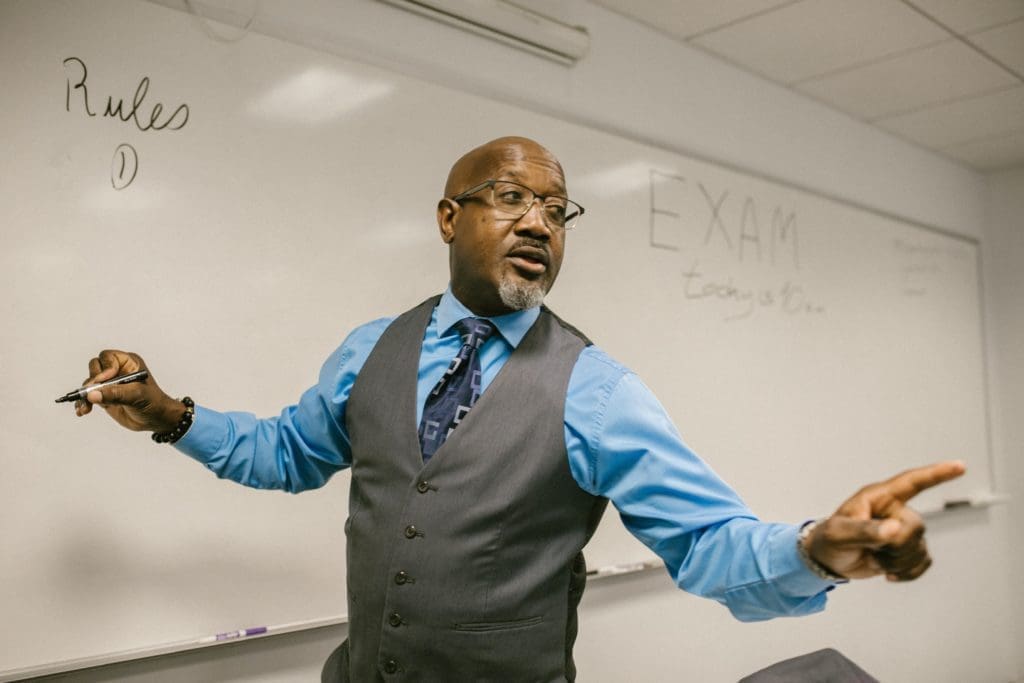

This is the first week of May, which means that it is also Teacher Appreciation Week and we want to celebrate teachers everywhere and express our gratitude. Your commitment to laying the groundwork for tomorrow's leaders is truly inspiring. We believe that everyone deserves a successful future, including you. We want to ensure that you have all of the essential estate planning documents to secure that future. To get that preparation started, we have some frequently asked questions listed about estate planning and how important it is to have a plan in place.

Having a proper legal plan is important for everyone, regardless of wealth. The term 'estate' refers to all of your possessions, such as bank accounts, real estate, household items, and vehicles. Essentially, it encompasses everything that you own. Once you pass away, everything in your estate is bequeathed to someone else.

Estate planning or asset protection planning, involves creating a comprehensive set of instructions for your trusted decision-makers to follow. These instructions are laid out in a series of legal documents that specify what should happen to your assets, finances, and other possessions after you pass away. In addition to distributing your estate, these documents can allow you to nominate a guardian for your minor children, and provide guidance for situations where you are unable to make your own decisions or require end-of-life care. A large number of people choose to work with an estate attorney, like us, to help them with this inheritance planning process.

Planning for retirement is essential to ensure that you are financially prepared for your post-work years. Your retirement plan options will vary depending on the school district you're in, so you may need to conduct a little research to see the basic features of your plan. Defined-benefit plans guarantee a specific payment amount, while defined contribution plans are based on investment results. To understand your plan's rules and requirements, consider the following questions:

The type of account your retirement plan is in decides the regulations that go with it. Understanding the terms and conditions for your specific plan is vital.

To create an effective estate plan, you must identify the documents that make up your plan. Having a will or trust already completed means that you are off to a good start. If you haven't started preparing any of the necessary documents yet though, there is no need to panic as we are here to help you create your comprehensive plan for any situation. As a teacher, you know the importance of having a well-organized plan, and we view your inheritance planning documents as the lesson plans that guide and protect your loved ones.

One part of asset protection planning can be developing a revocable living trust (RLT), which is a trust that you establish during your lifetime, which can be altered at any time until you become incapacitated or pass away. You can either transfer ownership of your accounts and property from yourself as an individual to yourself as the trustee of the trust or name the trust as the beneficiary of your accounts and property (with some exceptions). Although many may believe it, there is no requirement as to how much money and property you need to experience the benefits of a trust. The next step may involve figuring out how to choose a trustee as an RLT allows you to designate a co-trustee or substitute trustee if you become unable to act as trustee for any reason. An RLT also enables you to enjoy your money and property during your lifetime and to designate what will happen to it upon your death, safeguarding it for your chosen beneficiaries.

An RLT is an excellent way to provide instructions to your loved ones about how to handle the money and property owned by the trust. You can specify in the trust document how the money and property should be used during your incapacity and after your death. As an educator, an RLT offers an opportunity to provide younger beneficiaries with teachable moments. You can structure the trust to allocate a specified percentage to your loved one upon reaching a particular age (e.g., one-third at age thirty, one-half at age forty, and the remainder at age fifty). Alternatively, you can use an incentive trust to allow the trustee to give your loved one money only after achieving specific objectives (e.g., successfully completing a post-secondary education, being employed by the same employer for more than a year, being sober for one year, etc.). You can also use your trust to encourage charitable giving by allowing your loved one to select a charity to give a stated amount of money to, providing funding for a mission trip, etc.